change in net working capital as a percentage of change in sales

Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm. The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements.

Touch Base Tracker Tracker Planner Template Planner

Given those figures we can calculate the net working capital NWC for Year 0 as 15mm.

. Secondly the coming years sales forecast is. Compare the ratio against other companies in the same industry for additional. Net Working Capital Formula Current Assets Current Liabilities.

To calculate net sales subtract returns 400 from gross sales 25400. As for the rest of the forecast well be using the. The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent.

Either change is moving in a favorable direction or do we need to change our. Such a trend line is an excellent feedback mechanism for showing management the results of its decisions related to working capital. For working capital add the accounts receivable 8333 and inventory 12500 then subtract accounts payable 1042.

As used herein NWC means a the Net Book Value of the current assets of the Business listed on Section B-2 of the Disclosure Schedule less b the Net Book Value of the. For accounts payable are 20 million and sales are 100 million accounts payable as a percentage of sales would be 20. For the year 2019 the net working capital was 7000 15000 Less 8000.

Changing working capital does mean actual change in value year over year. Here are some examples of how cash and working capital can be impacted. As for the rest of the forecast well be using the.

In 3-statement models and other. Working capital as a percent of sales is calculated by dividing working capital by sales. For the year 2019 the net working capital was 7000 15000 Less 8000.

To get a real understanding of the companys operational efficiency we need to look at change in working capital. The working capital to gross revenues measure WCGR is a relative newcomer in financial analysis. Its primary benefit is measuring the amount of working capital needed or to specify the size of working capital requirements.

In general the higher the number the more financial risk is involved in company operations as it takes a higher degree of assets to run short-term operations. But if sales fall a scenario I worry about as a lender NWC may or may not shrink and free up cash to meet loan obligations. Net Working Capital NWC 75mm 60mm 15mm.

The formula is working capital divided by gross sales times. In this case the change is positive or the current working capital is more than the last year. Related to Working Capital as a Percentage of Sales.

Back to farm. The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements. The change in working capital value gives a real indication on why the.

And it helps determine this amount based on the total revenue or sales from an operation. This means that for a company with positive net working capital NWC will grow as sales grow and be a use of cash. For year 2020 the net working capital is 10000 20000 Less 10000.

Hence there is obviously an assumption that working capital and sales have been accurately stated. First each component of working capital as a percentage of sales is calculated. If a company collects 30000.

If no other expenses are incurred working capital will increase by 20000. But it means the change current assets minus the change current liabilities. If a company borrows 50000 and agrees to repay the loan in 90 days the companys working capital is unchanged.

If a transaction increases current assets and. Changes in working capital are reflected in a firms cash flow statement. If a business has high operating leverage then there.

Net change in Working Capital 1033 850 183. Now changes in net working capital are 3000 10000 Less 7000. It is used for many purposes in.

Changes in Net Working Capital. Calculation of the Sales to Working Capital Ratio. Target Net Working Capital Amount means an amount equal to the four 4 quarter average NWC as defined in this paragraph for 2015 for the Business.

The reason is that the current asset Cash increased by 50000 and the current liability Loans Payable increased by 50000. You could allow working capital to decline each year for the next 4 years from 10 to 6 and once this adjustment is made begin estimating the working capital requirement each year as 6 of additional revenues. Table 1012 provides estimates of the change in non-cash working capital on this firm assuming that.

Current Operating Assets 50mm AR 25mm Inventory 75mm. Now lets break it down and identify the values of different variables in the problem. Companies may over stock or under stock because of expectations of shortage of raw materials.

The percentage of sales method is the simplest and easiest way of finding future working capital. Plus as revenues rise or fall net working capital tends to stay constant as a percentage of sales. The sales to working capital ratio is calculated by dividing annualized net sales by average working capital.

If a business requires a lot of current assets to generate sales and those assets are funded by cash then the net working capital as a percentage of sales will likely be high. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Change in a Net Working Capital Change in Current Assets Change in Current Liabilities. The Change in Working Capital gives you an idea of how much a companys cash flow will differ from its Net Income ie after-tax profits and companies with more power to collect cash quickly from customers and delay payments to suppliers tend to have more positive Change in Working Capital figures.

Calculation of the Sales to Working Capital Ratio. The NWC relative to sales varies by industry as net working capital can represent 2 of sales or even 20 of sales. Calculate working capital as a percentage of sales using gross sales revenue figures from the profit-and-loss or income statement.

Musings On Markets Numbers And Narrative Modeling Story Telling And Investing Aswath Damodaran Valuation Drivers Investing Finance Investing Narrator

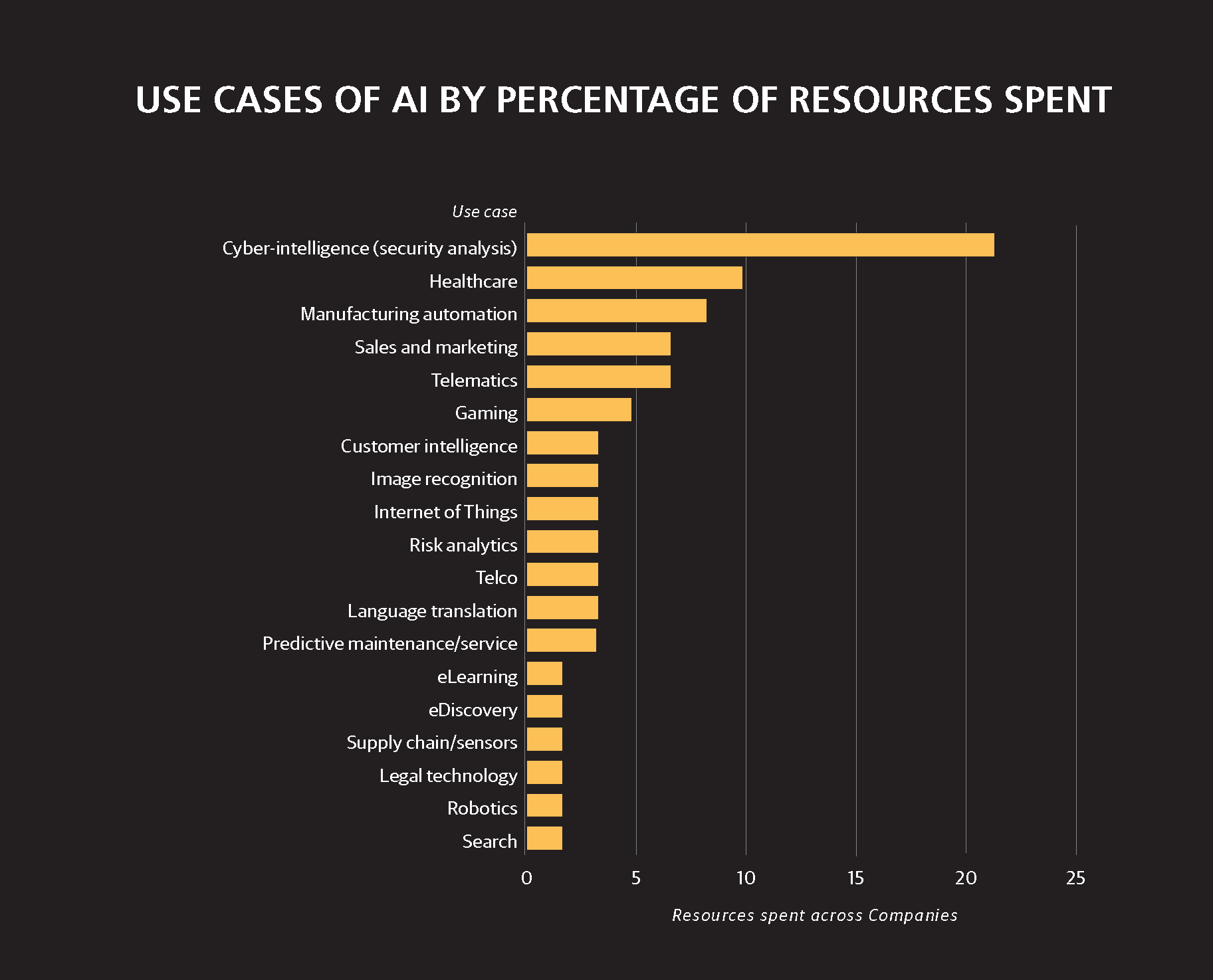

Use Cases Of Ai By Percentage Of Resources Spent Big Data Use Case Sales And Marketing

Attrition Report Excel Templates Excel Report Template

4 Free Math Worksheets Second Grade 2 Addition Adding Whole Hundreds 3 Addends N Free Business Card Templates Business Plan Template Business Proposal Template

Hierarchy Of Restaurant Jobs Restaurant Jobs Hierarchy Restaurant Management

Hr Manager Job Ad Description Template Google Docs Word Apple Pages Template Net Job Description Template Job Description Job Ads

Reza Ghaem Maghami On Twitter Google Ads Admissions Essay Revenue Chart

Modern Business Entrepreneur List Infographic Template Entrepreneur Infographic Infographic Templates Entrepreneur List

Job Interview Scoring Sheet Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Job Interview Interview Job

World Of Cryptocurrencies List Of Nations Cryptocurrency Bitcoin Trading

Interim Financial Statement Template Unique Interim Financial Statements Example Lux Statement Template Mission Statement Template Personal Financial Statement

Modern Business Entrepreneur List Infographic Template Entrepreneur Infographic Infographic Templates Entrepreneur List

10x Growth Challenge Prize Draw Challenges Coaching Program Workbook

Job Interview Scoring Sheet Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Job Interview Interview Job

Canpack A Leading Global Manufacturer Of Aluminium Beverage Cans Announced The Inauguration Of Its Aluminium Beverage Can Facil Ab Inbev Beverage Can Aluminium